Welcome to the forefront of the financial revolution, where artificial intelligence (AI) is not just a buzzword but a powerful force reshaping the landscape of financial services. In today’s digital age, AI’s significance transcends beyond mere automation, emerging as a pivotal element driving innovation, efficiency, and personalized customer experiences. The integration of AI within financial services is transforming operations, redefining customer interactions, and unveiling new paradigms in financial advisory and risk management.

At the heart of this transformation is the ability of AI to process and analyze vast amounts of data at unprecedented speeds, enabling financial institutions to unlock valuable insights, predict customer behavior, and make data-driven decisions. This ability is not just enhancing the way financial services operate but is also dramatically improving the way they engage with their customers, offering services that are more tailored, secure, and accessible than ever before.

This article dives deep into the transformative impact of AI on financial services, exploring its pivotal role in customer service and engagement, operational efficiency, and beyond. We aim to provide you with comprehensive insights into how AI is revolutionizing the sector, the challenges it brings, and the future it promises. Let’s embark on this journey to explore the AI revolution in financial services.

The AI Revolution: A Glimpse into 2024

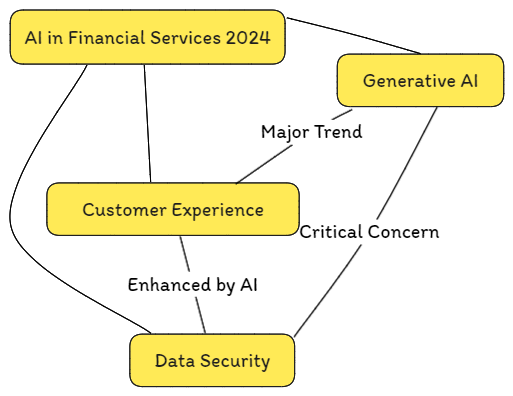

In the swiftly evolving landscape of financial services, Artificial Intelligence (AI) emerges as a beacon of innovation, driving unprecedented changes across the sector. As we edge closer to 2024, the integration of AI in financial services is not just a trend; it’s a revolution, poised to redefine how institutions interact with their customers, safeguard their operations, and leverage data for a competitive edge. At the forefront of this transformation is Generative AI, a technology that promises to unlock new levels of efficiency and personalization, pushing the boundaries of what’s possible in customer experience. However, with great power comes great responsibility, as the adoption of AI technologies brings to light critical concerns around data security.

AI’s Pivotal Role in Customer Service and Engagement

Enhancing Customer Interactions with AI

In the realm of customer service and engagement, AI is playing a game-changing role. Through personalized interactions and 24/7 support, financial institutions are leveraging AI to offer an unprecedented level of service. For example, chatbots and virtual assistants, powered by AI, are now capable of handling a wide range of customer queries in real-time, any time of the day. This not only enhances customer satisfaction but also significantly reduces the workload on human customer service representatives.

AI’s ability to provide a holistic view of the customer enables financial services to offer timely and personalized support, making the customer feel understood and valued. This personal touch, enabled by AI, is not just about solving problems quickly; it’s about building stronger, more personal relationships with customers.

AI and the Evolution of Financial Advisory

The democratization of financial advice is perhaps one of the most exciting developments in the AI revolution. Robo-advisors, driven by sophisticated AI algorithms, are making financial advisory services more accessible to the general public. Unlike traditional financial advisors, who are often associated with higher fees and require a certain level of investment, robo-advisors provide personalized, data-driven investment advice at a fraction of the cost.

This is a game-changer, especially for those who are new to investing or those who may not have large amounts of capital. AI-driven financial advisory services are helping to level the playing field, allowing more people to make informed investment decisions and plan for their financial future.

Operational Efficiency and Cost Reduction through AI

Automating Routine Tasks

The automation of routine tasks through AI is streamlining operations across the financial services sector, leading to significant cost reductions and efficiency improvements. By automating tasks such as data entry, transaction processing, and report generation, AI is not only speeding up operations but also reducing the potential for human error.

This shift towards automation allows employees to focus on more complex, value-added activities, thereby enhancing productivity and innovation. The operational efficiencies gained through AI are not just about doing things faster; they’re about doing them smarter and with greater accuracy.

Fraud Detection and Risk Management

AI’s impact on fraud detection and risk management is profound. Leveraging machine learning algorithms, financial institutions can now monitor transactions in real-time, identifying patterns and anomalies that may indicate fraudulent activity. This proactive approach to fraud detection not only helps in minimizing losses but also protects customers’ financial assets more effectively.

Moreover, AI-driven risk management tools are enabling institutions to assess and mitigate risks more accurately. By analyzing vast datasets, AI can predict potential defaulters or identify risky investment opportunities, thereby aiding in making more informed decisions. This level of insight and foresight was unimaginable a few decades ago, highlighting how AI is not just shaping the future of financial services but also securing it.

The Ethical and Compliance Landscape of AI in Finance

Addressing Bias and Ethical Concerns

As AI continues to weave its way into the fabric of financial services, it’s critical to address the elephant in the room—bias and ethical concerns. The thought of AI making decisions that affect people’s financial health brings with it a heavy load of responsibility. It’s not just about what AI can do, but also about doing it right, ensuring fairness, and maintaining transparency. After all, an AI system is only as unbiased as the data it’s fed, and historical data is not without its prejudices.

Financial institutions are tackling these challenges head-on, prioritizing the development of AI systems that are as impartial and ethical as possible. This involves everything from carefully curating the data used to train AI models, to implementing regular audits of AI algorithms for fairness. The goal? To ensure that AI decisions don’t inadvertently discriminate and that every customer, regardless of background, is treated fairly.

AI Compliance and Data Protection

In the world of finance, trust is everything. Customers entrust their most sensitive information to financial institutions, expecting privacy and security in return. Enter regulations like the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in the U.S., setting the bar high for data protection.

These regulations compel institutions to adopt a privacy-by-design approach in their AI systems, ensuring that customer data is protected from the get-go. Strong data security measures and adherence to local and international data protection laws are not just about compliance; they’re about maintaining customer trust and avoiding hefty penalties. By integrating these principles, financial services can navigate the complex landscape of AI compliance, ensuring their AI innovations are both groundbreaking and responsible.

Implementing AI Strategies in Financial Services

A Step-by-Step Guide to AI Integration

Implementing AI in financial services isn’t a one-size-fits-all process, but there are some common steps that institutions can follow to ensure a smooth transition. It starts with defining clear objectives—what do you want AI to achieve? From enhancing customer experience to improving operational efficiency, setting clear goals is crucial.

Next up, data. AI thrives on data, so ensuring access to high-quality, relevant data is a must. This is followed by selecting the right technology and partners. Whether it’s building in-house AI capabilities or collaborating with fintech startups, choosing the right allies is key to unlocking AI’s potential.

Then comes the integration phase, where AI systems are carefully implemented into existing workflows. This step requires meticulous planning and testing to ensure minimal disruption. Finally, continuous monitoring and adaptation are essential. AI systems are not set-it-and-forget-it; they require ongoing tuning and adjustment to stay effective and ethical.

Case Studies: Real-world Examples of Successful AI Applications in the Finance Sector

Let’s look at some success stories where AI has made a significant impact in finance. One standout example is the use of AI in credit scoring. Traditional credit scoring methods often overlook potential creditworthy individuals due to a lack of traditional credit history. AI, with its ability to analyze alternative data sources, has enabled more inclusive credit scoring models, opening up new opportunities for those previously underserved by the financial system.

Another example is AI-powered fraud detection systems. By analyzing transaction patterns in real time, AI systems can identify and flag suspicious activities with unprecedented speed and accuracy, significantly reducing the incidence of financial fraud.

Future Trends: AI’s Next Frontier in Financial Services

Emerging AI Technologies

As we peer into the future of financial services, several emerging AI technologies stand out for their potential to redefine the industry. Generative AI models, which can create realistic text, images, and voice outputs, are paving the way for more sophisticated customer interaction tools, beyond the chatbots we’re familiar with today. Imagine getting financial advice or discussing investment strategies with an AI that not only understands your query but can also simulate human empathy and understanding.

Another promising area is AI-driven predictive analytics, which goes beyond traditional analytics by not only interpreting data but also forecasting future trends with remarkable accuracy. This could revolutionize areas such as market analysis, investment strategy formulation, and risk management, allowing financial institutions to stay several steps ahead of market movements.

Blockchain and AI are converging to offer more secure, efficient, and transparent financial services. AI can enhance blockchain operations with improved consensus mechanisms and smarter contracts, while blockchain can provide a secure and unalterable database for AI operations, enhancing trust in AI decisions.

The Role of AI in Financial Inclusion

AI is playing a crucial role in bridging the gap for underserved communities, offering financial services to those who previously had limited access. By leveraging alternative data (such as mobile phone usage patterns, utility payments, and even social media activity), AI is enabling financial institutions to assess creditworthiness more holistically. This approach opens up access to credit for millions of people who lack traditional credit histories, thereby promoting financial inclusion.

AI is also simplifying and demystifying financial services for the average user, making it easier for people from all walks of life to access and understand financial products. This is particularly important in developing regions, where financial literacy levels may be lower, and traditional banking services may be out of reach for large segments of the population.

Top 5 AI Innovations Transforming Financial Services

- Conversational AI: Beyond chatbots, conversational AI is creating more nuanced and natural interactions between customers and financial services, making customer service more accessible and efficient.

- Intelligent Document Processing (IDP): IDP systems can extract, process, and understand information from a variety of document types, significantly speeding up processes like loan applications, insurance claims, and KYC (Know Your Customer) procedures.

- Predictive Analytics: By forecasting future customer behavior and market trends, predictive analytics can help financial institutions offer more personalized products, manage risks more effectively, and identify new opportunities.

- Robo-advisors and Automated Trading Systems: These systems provide personalized investment advice and execute trades at optimal times, democratizing access to investment strategies that were once the preserve of the wealthy.

- Fraud Detection and Security: Advanced AI algorithms are capable of detecting fraudulent activities in real-time by analyzing transaction patterns, significantly enhancing security for financial institutions and their customers.

AI as a Catalyst for Financial Empowerment

The integration of AI in financial services is not merely a technological upgrade; it’s a paradigm shift that heralds a new era of growth, innovation, and accessibility. Industry leaders are vocal about AI’s potential to democratize financial services, making them more inclusive and accessible to a broader audience. The consensus is that AI can bridge the gap between traditional banking services and underserved communities, offering a pathway to financial empowerment for millions worldwide. The vision for the future is clear: a world where financial services are no longer the preserve of the few but are accessible to all, powered by AI. This vision is grounded in the belief that AI can drive significant growth within the sector, not just by cutting costs or enhancing efficiency, but by creating entirely new services and business models that were previously unimaginable.

FAQs: Addressing Common Questions about AI in Financial Services

Can AI really improve customer service in financial services?

Absolutely. AI-driven chatbots and virtual assistants are already providing 24/7 support, answering queries, and offering personalized advice, significantly enhancing the customer service experience.

Is my data safe with AI-driven financial services?

Yes, data protection is a top priority. Financial services using AI adhere to strict data protection regulations like GDPR and CCPA, ensuring your data is handled securely and responsibly.

Will AI replace human workers in finance?

While AI automates routine tasks, it’s also creating new opportunities for human workers to engage in more complex, strategic roles. The aim is to complement human expertise, not replace it.

How does AI contribute to financial inclusion?

By using alternative data to evaluate creditworthiness, AI enables financial services to reach underserved communities, offering them credit and other financial products for the first time.

Are AI-driven financial advisors as effective as human advisors?

AI-driven robo-advisors can offer personalized, data-driven investment advice, making financial advisory accessible to a wider audience. They’re an effective option for many investors, especially for standard portfolio management.

Conclusion: Reflecting on AI’s Transformative Journey in Finance

As we’ve explored the myriad ways in which AI is reshaping the financial services landscape, it’s clear that its impact is profound and multifaceted. From revolutionizing customer service with 24/7 virtual assistants to driving financial inclusion by leveraging alternative data for credit assessments, AI is not just changing how financial institutions operate; it’s changing who can access financial services in the first place. The future trajectory of AI in financial services is brimming with potential, poised to continue its transformative journey, reshaping the industry landscape in ways we’re just beginning to understand. As we move forward, the fusion of AI and finance promises to usher in an era of unprecedented growth, innovation, and accessibility, empowering individuals and communities across the globe.