In the rapidly evolving fintech sector, Artificial Intelligence (AI) has become a cornerstone of innovation, particularly in enhancing customer experiences. AI, with its diverse capabilities ranging from machine learning to predictive analytics, is fundamentally transforming the fintech landscape. It’s not just about automating tasks; AI is reimagining how financial services can be delivered and experienced by customers. This transformative power of AI extends across various domains within fintech, including customer service, fraud detection, and personalized financial advice, offering a glimpse into a future where financial services are more accessible, secure, and tailored to individual needs.

The aim of this exploration into AI’s application in fintech is twofold. First, to understand how AI is driving improvements in customer service—making interactions more intuitive and responsive. Second, to delve into AI’s critical role in enhancing security measures through advanced fraud detection algorithms and offering personalized financial guidance through robo-advisors. By examining these areas, we can uncover the potential AI holds in not just meeting but exceeding customer expectations in the fintech industry.

AI’s Transformative Impact on Fintech

Beyond Traditional Banking

AI is leading a paradigm shift in banking and financial services, moving beyond the traditional banking model to a more dynamic, customer-centric approach. With AI, fintech companies are not just automating processes but are also leveraging data to gain deeper insights into customer behavior and preferences. This transition towards AI-driven services is facilitating a more engaging and personalized customer experience, breaking down the barriers of conventional banking and allowing for more innovative service delivery models.

AI in Fraud Detection

One of the most significant applications of AI in fintech is in the area of fraud detection. By analyzing vast datasets and identifying patterns, AI algorithms can spot unusual transaction activities that may indicate fraudulent behavior. This capability to learn from historical data and adapt to new fraudulent techniques in real-time positions AI as a critical tool in the fight against financial fraud, ensuring customer assets are safeguarded with the most advanced technology available.

Revolutionizing Customer Service with AI

Chatbots and Virtual Assistants

In the domain of customer service, AI-powered chatbots and virtual assistants are making significant strides. These AI solutions are available around the clock, providing instant support and personalized assistance to customers. From handling basic inquiries to assisting in complex financial decisions, chatbots are becoming an integral part of the customer service ecosystem in fintech, offering a seamless experience that rivals human interaction. The use of natural language processing ensures that these interactions are as natural and intuitive as possible, significantly enhancing customer satisfaction.

Enhancing Financial Advisory Services

Robo-advisors represent another key area where AI is making an impact in fintech. Utilizing advanced algorithms to analyze personal financial data, these AI-driven platforms offer personalized investment advice tailored to individual goals and risk tolerances. This democratization of financial advice means that more people have access to investment guidance that was once available only through high-cost advisory services. As robo-advisors continue to evolve, they promise to deliver even more sophisticated and personalized financial planning services, making investing more accessible and aligned with personal financial objectives.

Streamlining Operations and Risk Management

Automating Routine Tasks

The infusion of AI into fintech has revolutionized operational processes by automating a slew of routine tasks, markedly enhancing both efficiency and accuracy. From processing customer transactions to conducting account reconciliations, AI’s prowess in handling time-consuming tasks that once bogged down human workers is undeniable. This automation not only speeds up operations but also drastically reduces the margin for error inherent in manual processing. Furthermore, AI’s ability to analyze and organize vast amounts of data in real-time empowers financial institutions to make more informed decisions, fostering a more dynamic and responsive fintech ecosystem.

Advanced Risk Management Techniques

AI’s impact extends into the realm of risk management, where its advanced analytical capabilities are being leveraged to foresee and mitigate financial risks. Through the use of machine learning models, AI can predict market trends, evaluate the creditworthiness of borrowers, and even anticipate potential loan defaults with a high degree of accuracy. This predictive power allows financial institutions to make more nuanced decisions, tailoring their services to minimize risk while maximizing potential gains. Moreover, AI’s ongoing analysis helps keep pace with the ever-evolving landscape of financial risk, ensuring that risk management strategies remain relevant and effective.

Implementing AI in Fintech Strategies

A Step-by-Step Guide to AI Adoption

Implementing AI within fintech operations isn’t a straightforward task; it requires a nuanced understanding of both AI capabilities and the specific needs of the fintech sector. The journey begins with a thorough assessment of the company’s existing systems and processes to identify areas where AI can provide the most impact. Following this, fintech companies must navigate the selection and integration of AI technologies, which involves choosing between developing in-house solutions or partnering with established AI providers. Key to this process is ensuring that AI implementations align with the company’s strategic goals, enhancing customer experiences and operational efficiency without compromising security or compliance.

Challenges and Solutions

Despite the clear benefits, integrating AI into fintech is not without its challenges. Issues such as data privacy, security concerns, and the potential for bias in AI algorithms can pose significant hurdles. Additionally, the complexity of regulatory environments across different regions adds another layer of complexity to AI adoption. To navigate these challenges, fintech companies must prioritize transparency and ethical AI use, implementing robust data governance frameworks and continuously monitoring AI systems to identify and correct biases. Engaging with regulatory bodies and staying abreast of changes in the legal landscape will also be crucial for ensuring compliance and maintaining customer trust. Collaboration with AI research organizations and investing in employee training and development can help fintech firms stay at the cutting edge of AI technology, enabling them to overcome obstacles and harness the full potential of AI to revolutionize financial services.

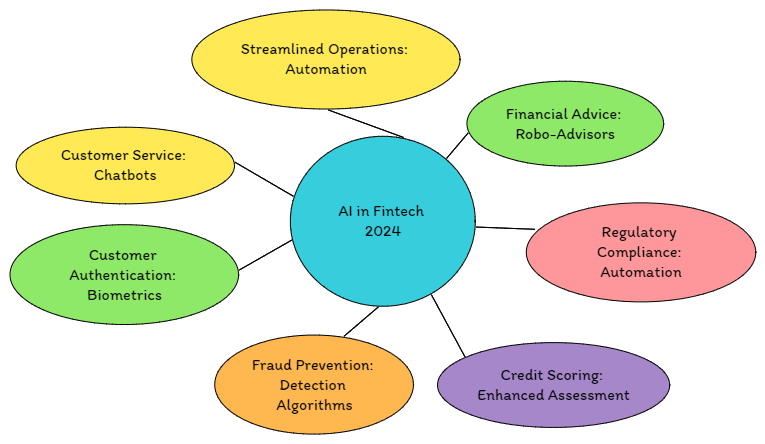

AI in Fintech 2024: Transforming Financial Services

As we step into 2024, the fintech landscape is poised for a significant transformation driven by Artificial Intelligence (AI). This mindmap outlines the pivotal areas where AI is set to make its mark, from revolutionizing customer service with AI-powered chatbots to enhancing credit scoring and streamlining operations through automation. Other critical areas include bolstering security measures through advanced fraud prevention algorithms, refining regulatory compliance processes, and introducing biometric methods for customer authentication.

These developments highlight a future where financial services are more personalized, secure, and efficient, showcasing the potential of AI to redefine the fintech sector. As companies adopt these technologies, they pave the way for a new era of financial innovation that promises to make financial services more accessible and tailored to individual needs.

The Future of AI in Fintech

Emerging AI Technologies

The horizon of AI in fintech is vibrant with emerging technologies poised to push the boundaries of what’s possible. Among these, generative AI stands out for its potential to create highly personalized financial content, from customized investment reports to tailored financial advice, revolutionizing customer interactions with financial platforms. Additionally, quantum computing is on the cusp of transforming financial modeling and risk assessment by processing complex computations at speeds unimaginable with today’s technology. Blockchain, when combined with AI, promises enhanced security and transparency in transactions, further building trust in fintech services. These innovations signal a shift towards more intuitive, secure, and personalized financial services, fundamentally changing how consumers and businesses interact with finance.

The Role of AI in Financial Inclusion

AI’s potential to foster financial inclusion cannot be overstated. By leveraging AI to analyze non-traditional data sources for credit scoring, fintech companies can extend financial services to previously underserved populations, including those without formal credit histories. This approach not only broadens access to credit but also opens up opportunities for personalized financial products tailored to the unique needs of diverse consumer segments. Furthermore, AI-driven financial education tools are democratizing financial knowledge, empowering individuals to make informed financial decisions. In essence, AI is breaking down the barriers to financial services, ensuring that financial empowerment is accessible to all, regardless of socioeconomic background.

Top AI Innovations in Fintech

- Predictive Analytics: AI’s ability to predict customer behavior and market trends is revolutionizing customer engagement and risk management in fintech, offering insights that drive personalized services and mitigate financial risks.

- AI in Credit Scoring: By using machine learning algorithms to analyze alternative data, fintech companies can provide credit scores for individuals without traditional credit histories, opening up access to financial services for a broader population.

- Chatbots and Virtual Assistants: The evolution of AI-powered chatbots has transformed customer service in fintech, providing 24/7 support, handling transactions, and offering personalized financial advice, significantly enhancing the customer experience.

- Fraud Detection: Advanced AI algorithms are at the forefront of detecting and preventing fraudulent activities by analyzing transaction patterns in real-time, ensuring the security of financial transactions.

- Robo-advisors: These AI-driven platforms offer customized investment advice by analyzing an individual’s financial data, goals, and risk tolerance, making financial planning and investing accessible and personalized.

The integration of AI into fintech is not just transforming the sector; it’s reshaping the very landscape of financial services. From enhancing operational efficiency to democratizing access to financial services, AI innovations are at the heart of fintech’s evolution, driving towards a future where financial services are more inclusive, personalized, and secure.

Navigating the AI Landscape in Fintech

In the world of fintech, AI is not just a technological advancement; it’s a paradigm shift. Experts across the board are optimistic about AI’s potential to catalyze growth, spur innovation, and elevate customer satisfaction. They envision a future where AI seamlessly integrates into every facet of financial services, from operational efficiency to personalized customer interactions. The consensus among thought leaders is clear: the strategic application of AI will not only streamline processes but also unlock new avenues for customer engagement and service delivery that were previously unimaginable. By harnessing AI, fintech companies can anticipate customer needs, tailor their offerings, and set new standards in the financial landscape, ultimately driving a more inclusive and innovative sector.

Some FAQs Answered on The Relevant Topic

How does AI enhance customer experience in fintech?

AI improves customer experience by providing personalized interactions, instant support through chatbots, and tailored financial advice, making services more responsive and intuitive.

Are there ethical concerns with using AI in fintech?

Yes, ethical concerns include potential biases in AI algorithms and privacy issues. Fintech companies address these by ensuring diversity in training data, auditing algorithms for fairness, and adhering to strict data protection regulations.

Can AI in fintech lead to job displacement?

While AI automates routine tasks, it also creates opportunities for new roles focused on AI management and strategy, suggesting a shift in job dynamics rather than outright displacement.

How does AI contribute to financial inclusion?

AI facilitates financial inclusion by using alternative data for credit scoring, enabling access to financial services for underserved populations, and providing educational tools for financial literacy.

Conclusion: Embracing AI for a Customer-Centric Fintech Future

The integration of AI into fintech marks a significant milestone in the evolution of financial services. Through its transformative impact, AI has the potential to enhance every aspect of fintech, from improving operational efficiencies and managing risks to revolutionizing customer service and fostering financial inclusion. As we move forward, the strategic integration of AI will be pivotal for fintech companies aiming to stay competitive and meet the ever-evolving demands of customers. Embracing AI is not just about adopting new technologies; it’s about reimagining the future of financial services to create a more personalized, accessible, and customer-centric experience.